Against the backdrop of global energy transition and trade policy adjustments, the enameled wire industry is undergoing profound changes.The explosive growth in the new energy sector is driving demand for high-end products, while U.S. tariff policies are compelling Chinese companies to accelerate their global expansion, reshaping the competitive landscape of the industry.

New Energy Demand Drives Industry Upgrades

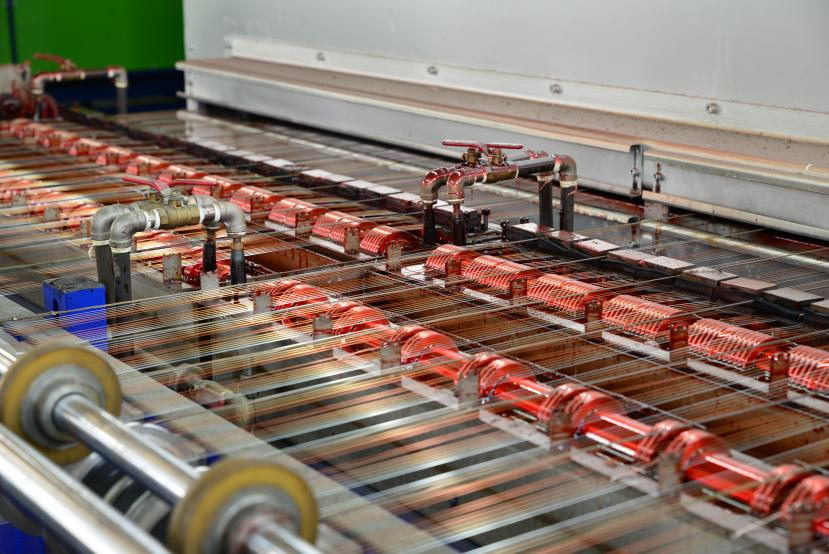

1.Electric Vehicles Fuel Demand for Flat Wire

With global EV penetration exceeding 20%, hairpin motors have become the mainstream technology. Orders from automakers like BYD and Tesla are driving companies such as Jingda Special Wire and Great Wall Technology to expand production. Data shows that the flat enameled wire market is expected to reach ¥8.5 billion in 2024, a 35% year-on-year increase.

2.Wind and Solar Power Boost Weather-Resistant Products

Offshore wind and solar inverters are driving demand for high-temperature and salt-spray-resistant enameled wires. Companies like Golden Cup Electric and Luxshare Tech are accelerating R&D on polyimide composite-insulated wires, with some products already certified by DNV-GL and entering global supply chains.

3.Energy Storage Emerges as a New Growth Driver

The expansion of global energy storage battery production is increasing demand for high-frequency transformer wires. Domestic firms like Guancheng Datong have launched low-loss, high-thermal-conductivity products to capture markets in Europe and the U.S.

U.S. Tariffs Force Global Expansion

1.High Tariffs Weaken Export Competitiveness

Since the U.S. imposed 25% tariffs on Chinese enameled wires in 2018, exports to the U.S. have plummeted by 63%. The 2024 review maintained these rates, with some anti-dumping duties reaching 60%, diverting orders to Japanese and Korean suppliers.

2.Chinese Firms Accelerate Overseas Expansion

Golden Cup Electric is investing $120 million in a Thai plant (operational by 2025), targeting Southeast Asia and Western markets.

Tongling Jingda is partnering with Mexican firms to leverage USMCA tariff benefits for U.S. exports.

Dongguan Securities notes that overseas relocation can reduce costs by 15%-20%, though local supply chain limitations remain a challenge.

3.Alternative Markets Rise

The EU and Southeast Asia are becoming new growth hubs, with China's 2023 exports to the EU up 17% and shipments to Vietnam and India surging over 30%.

Technological Innovation as a Key Solution

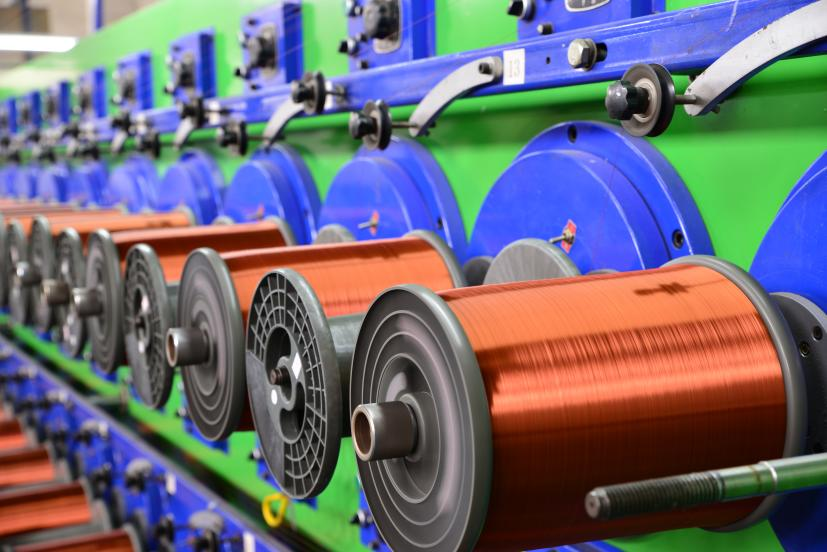

1.Breakthroughs in Ultra-Fine Wire

Elektrisola has mass-produced 0.010mm ultra-fine enameled wire for medical micro-motors and consumer electronics, commanding 3-5x the price of conventional products.

2.High-Voltage Material Advancements

UBE launched a nano-ceramic composite wire with corona resistance of 5kV/mm, compatible with 800V fast-charging platforms and certified by multiple automakers.

3.Green Manufacturing Gains Traction

The EU’s new regulation (EU 2023/814) restricting halogen content is accelerating adoption of solvent-free and water-based insulation technologies. Leading Chinese firms like ELANTAS have already established eco-friendly production lines.

IV. Challenges and Opportunities

Challenges:

Volatile raw material (copper, insulating varnish) prices squeeze profit margins. Persistent U.S. trade barriers increase compliance costs. Rising competition from local Southeast Asian producers (e.g., Vietnam’s Pancera).

Opportunities:

Emerging sectors like humanoid robots and nuclear fusion create new demand. China’s "Motor Energy Efficiency Upgrade" policy promotes 200°C high-temperature wire adoption. RCEP regional supply chain integration lowers overseas expansion costs.

V. Future Outlook

Industry analysts forecast the global enameled wire market will exceed $14 billion by 2025, with new energy applications accounting for over 40%. Chinese firms must focus on high-end innovation, globalization, and sustainability to navigate trade tensions and technological evolution.

Post time: Apr-24-2025